- Transactions

- User Journey: Add a Transaction

- User Journey: Import Transactions via CSV Upload

- User Journey: Add a Rule

- User Journey: View & Manage All Rules

- User Journey: Apply Filters on Transaction List

- Export All Transactions

- User Journey: Show All Transactions

- User Journey: Update Transaction

- User Journey: View Transaction History

- User Journey: Delete a Transaction

Transactions #

Track and manage your financial activity across all account types with advanced control:

- Transaction Management: Access all your transactions in one place—automatically fetched via Plaid, added manually, or imported in bulk for convenience.

- Account Integration: Transactions are linked to accounts such as checking, savings, credit cards, cash, uncategorized, and others.

- Custom Rules Engine: Set up custom rules to automatically rename or re-categorize transactions based on keywords or patterns in the transaction names, making your data cleaner and easier to analyze.

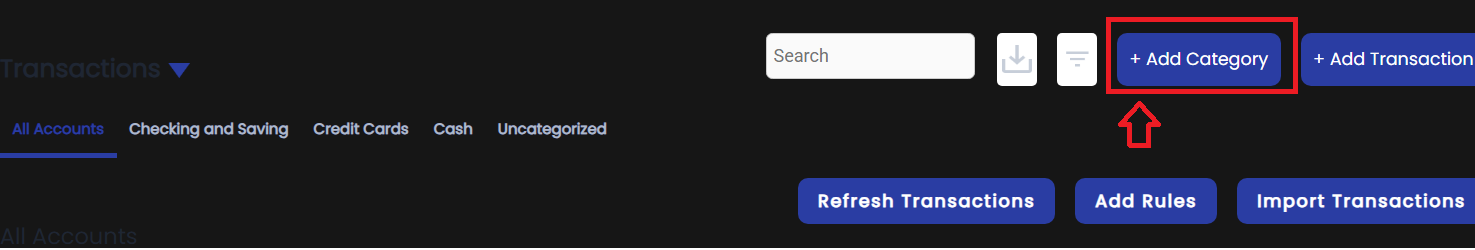

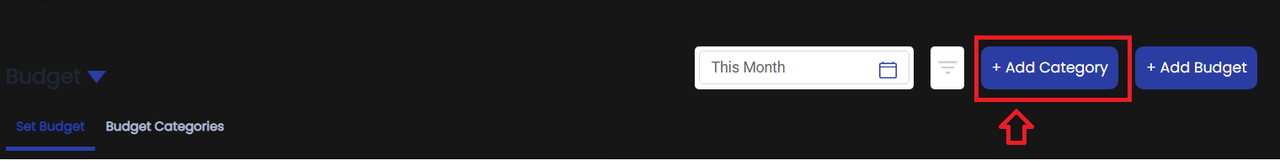

Add category user journey:

Goal: Add a new category for organizing transactions or budgeting.

Entry Points: #

- From Budget section → “Add Category”

- From Transaction editing screen → “Create New Category”

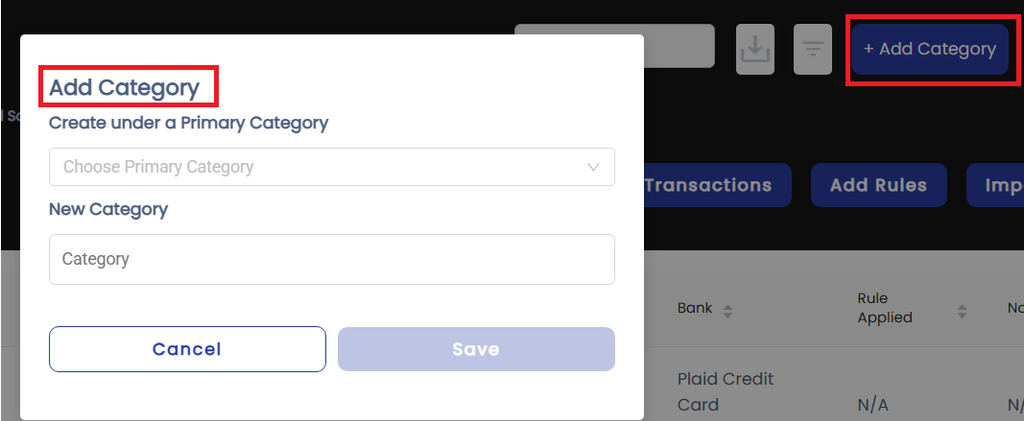

Steps: #

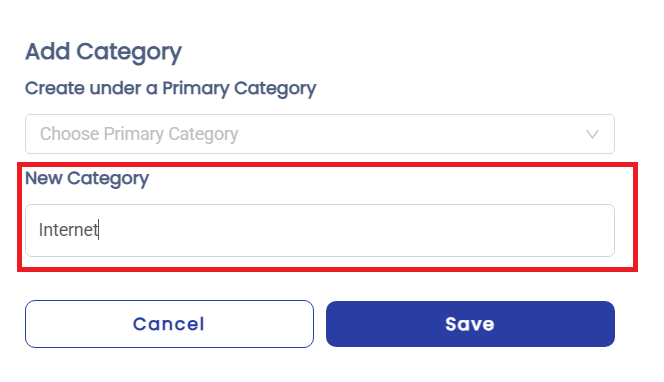

- User clicks “Add Category”

– Opens New Category Form

- User enters Category Name

– e.g.,”Utilities”, “Internet”

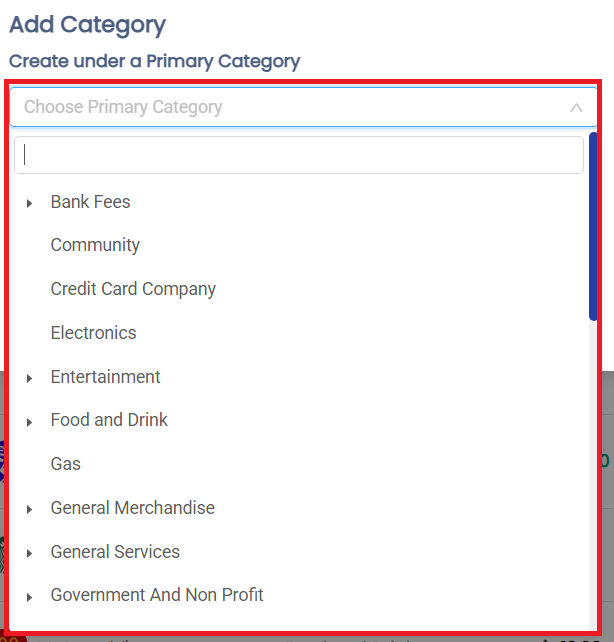

3 .User chooses whether to assign a Primary Category:

– Dropdown: “Select Primary Category (Optional)”

– Options populated from existing categories

- Decision Point:

- If Primary Category is selected:

→ The new category becomes a Subcategory under the selected Primary

e.g., “Internet” becomes a subcategory of “Utilities” - If no Primary Category is selected:

→ The entered category becomes a Primary Category

- If Primary Category is selected:

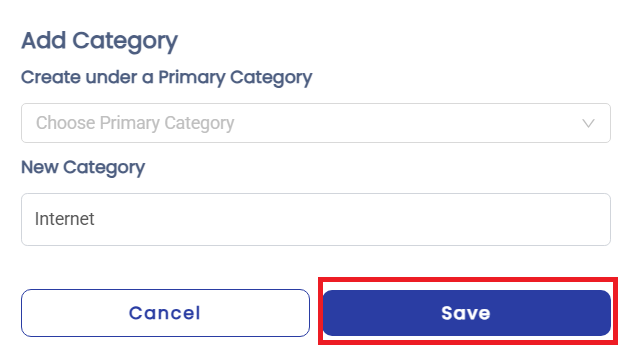

- User clicks “Save”

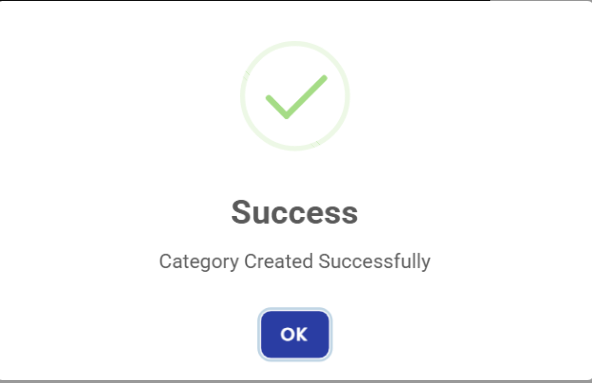

- Confirmation:

- Category is added to the system

- Appears in category list (structured with nesting if subcategory)

- Category is added to the system

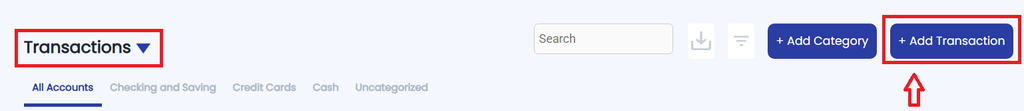

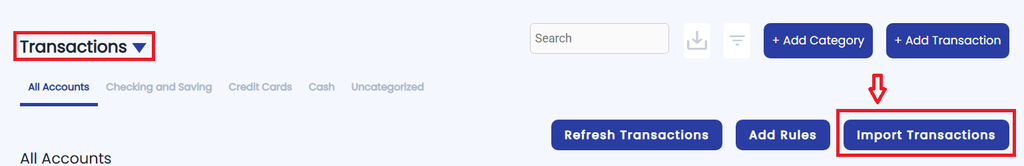

User Journey: Add a Transaction #

Goal: Manually log a transaction (either expense or income) into the system.

Entry Points: #

- From Transactions tab → “+ Add Transaction”

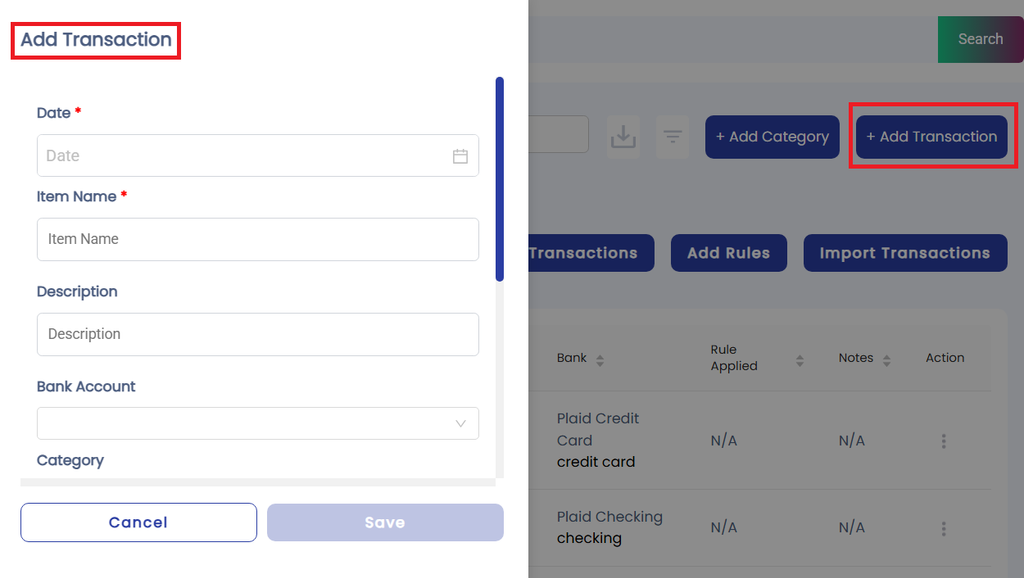

Steps: #

- User clicks “Add Transaction”

- Opens the New Transaction Form

- User fills out the form:

- Date:

Select the transaction date using a date picker

(Default: today’s date) - Item Name:

Enter a short, recognizable name (e.g., “Target”, “Paycheck”)

(Used for rule-matching if applicable) - Description (optional):

Enter a longer detail (e.g., “Weekly groceries” or “March Salary”) - Bank Account Dropdown:

Choose from linked accounts: Checking, Savings, Credit Card, Cash, etc. - Category Dropdown:

Select an existing category or click “Create New Category”

(Nested categories shown if subcategories exist) - Type (Expense or Income):

- Choose either Expense or Income

- Amount:

Input numeric value

(Validation: must be greater than 0) - Payment Mode:

Choose either Cash or Cheque - Notes (optional):

Add any additional context (e.g., “Split with roommate”)

- Date:

- User clicks “Save”

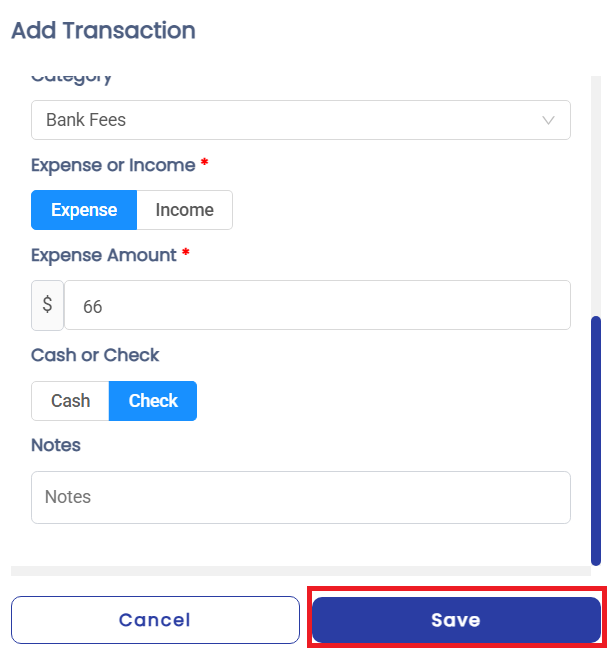

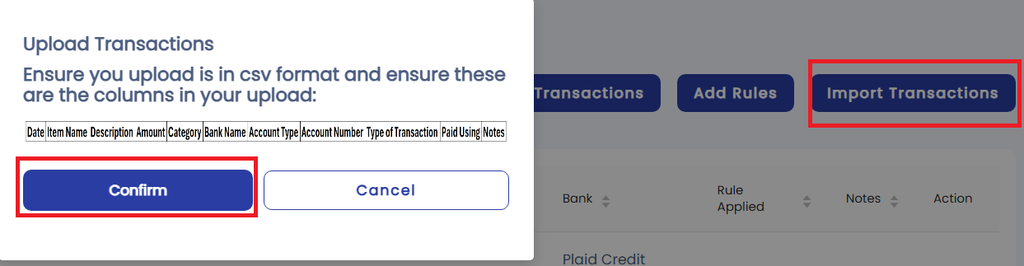

User Journey: Import Transactions via CSV Upload #

Goal: Upload a batch of transactions through a properly formatted CSV file.

Entry Points: #

- From Transactions tab → “Import Transactions”

Steps: #

- User clicks “Import Transactions”

- Opens the CSV Upload Interface

CSV Template Format: #

The template includes the following columns:

| Date | Item Name | Description | Amount | Category | Bank Name | Account Type | Account Number | Type of Transaction | Paid Using | Notes |

| YYYY-MM-DD | Text | Text | Number | Text | Text | Text | Number | Expense or Income | Cash or Cheque | Text |

- User selects the CSV file from the system.

- User gets the confirmation after importing the transactions.

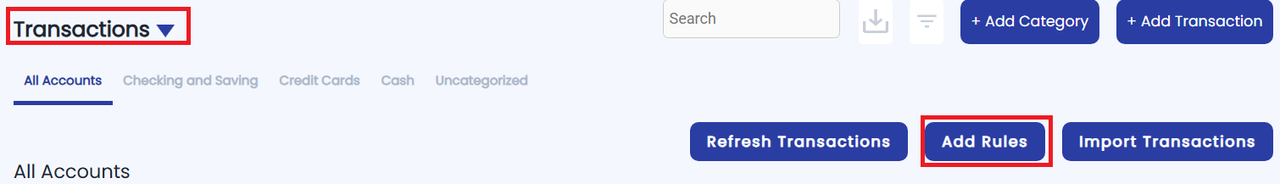

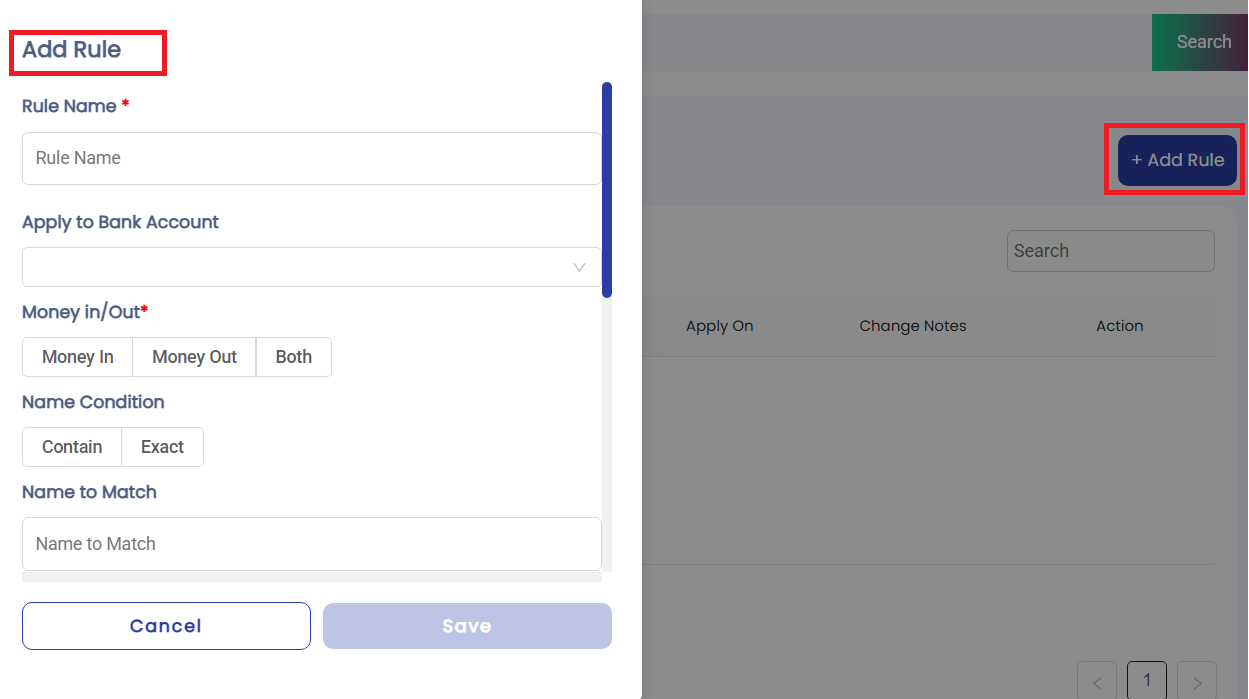

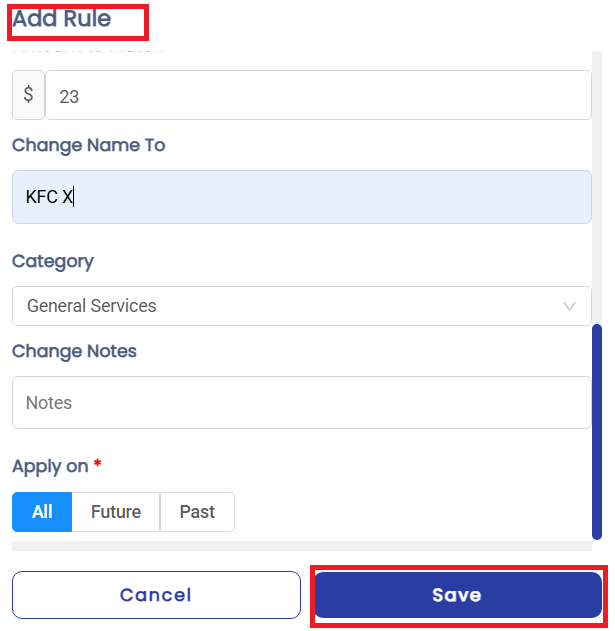

User Journey: Add a Rule #

Goal: Automate the handling of transactions by defining rules that match specific criteria and apply changes such as name, category, or notes.

Entry Points: #

- From Transactions tab → “Add Rule”

Steps: #

- User clicks “Add Rule”

– Click → “+ Add Rule

– Opens the New Rule Form

2. User fills out the form:

- Rule Name:

A custom name for easy identification (e.g., “Amazon Purchases”) - Apply to Bank Account:

Dropdown with all linked accounts

(Can be “All Accounts” or specific one) - Transaction Type:

- Select button: Money In, Money Out, or Both

- Match Type:

- Contains → Flexible partial match

- Exact → Full string match

- Name to Match:

Enter keyword or phrase to look for in transaction name

(e.g., “Amazon”, “Uber”) - Amount Condition (Optional):

- Select button: Equals, Greater than, Less than, etc.

- Amount to Match:

Value to compare against the transaction amount - Change Name To:

Enter new name that will replace the original

(e.g., “Amazon – Shopping”) - Assign Category:

Select category (e.g., “Shopping”, “Transportation”) - Change Notes (Optional):

Add or replace notes automatically - Apply Rule To:

- All Transactions

- Future Transactions Only

- Past Transactions Only

3. User clicks “Save Rule”

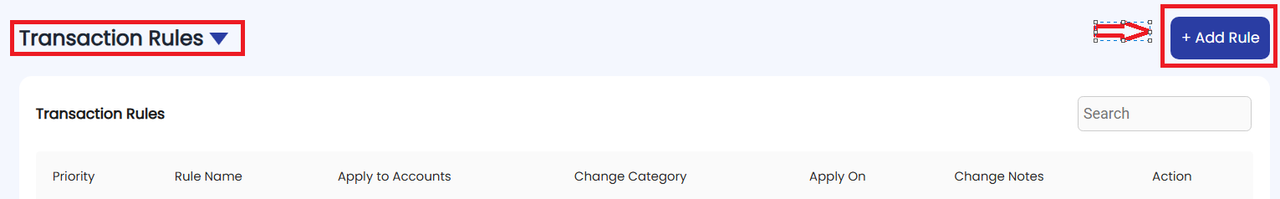

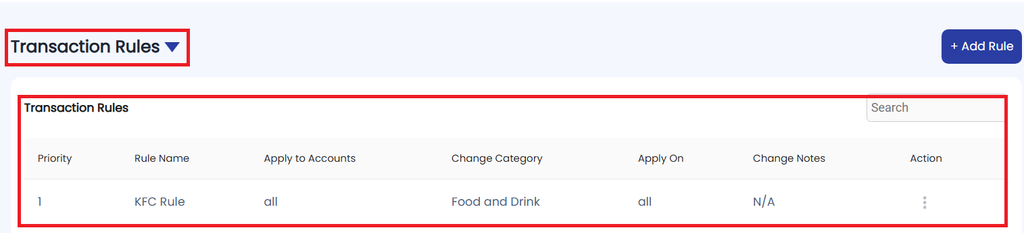

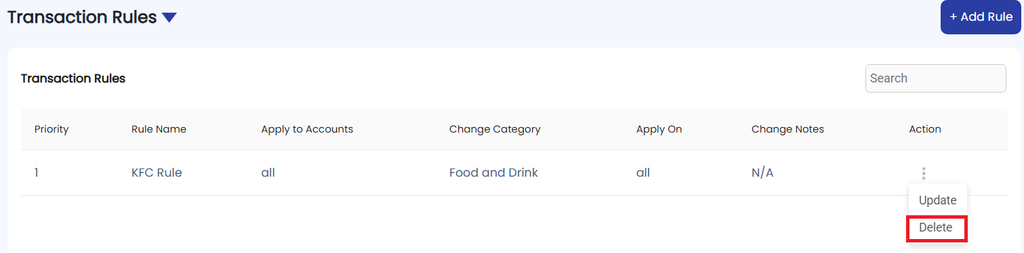

User Journey: View & Manage All Rules #

Goal: Access, review, edit, and manage all transaction rules set by the user to automate transaction handling.

Entry Points: #

- From Transactions tab → “Add Rules” → “View All Rules”

Steps: #

- User navigates to “All Rules”

- Arrives at the Rules List Screen

- User sees a list of saved rules, each displayed as row with:

- Rule Name

- Applies to Accounts

- Change Category

- Applied on: All / Future / Past

- Changes Notes

- Actions: Update/Delete

User Actions on Rule List:

#

- Edit a Rule:

– Click “Edit” to reopen the rule form with pre-filled data

– Make changes and resave

- Delete a Rule:

– Click “Delete” with confirmation prompt

– Immediate effect on future transactions, and optionally undo changes on past ones

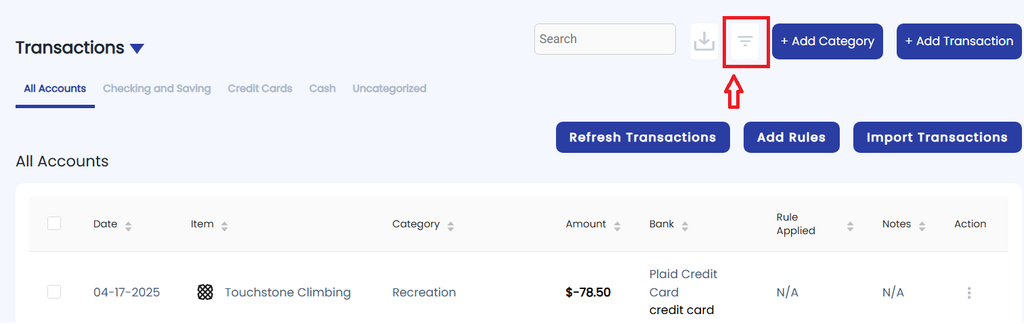

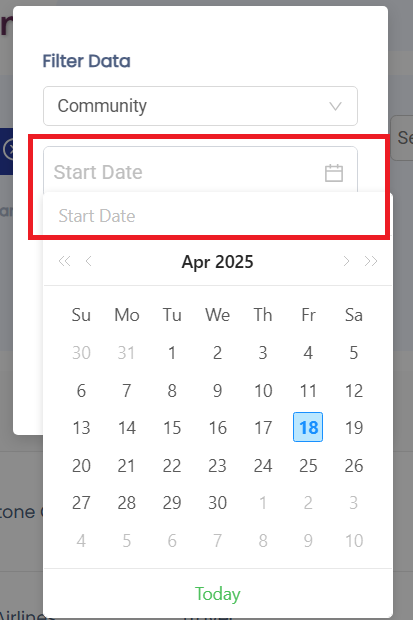

User Journey: Apply Filters on Transaction List #

Goal: Allow the user to view only specific transactions based on category and time period.

Entry Points: #

- User lands on Transactions page

- Filters are visible at the top of the transaction list

Steps: #

- User accesses the Transactions list

- Sees all transactions by default (no filters applied)

- User clicks or taps on the “Category” dropdown:

- Sees all available categories (including nested subcategories if any)

- Selects one category

(e.g., “Groceries” or “Utilities > Internet”)

- Sees all available categories (including nested subcategories if any)

- User selects a Start Date:

- Opens date picker or calendar input

- Selects the beginning of the range

(e.g., March 1, 2025)

- Opens date picker or calendar input

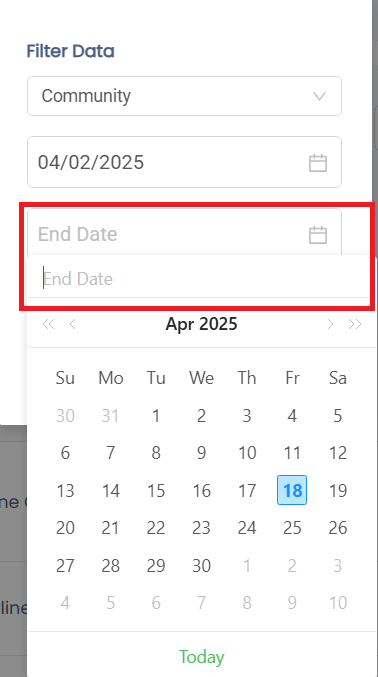

4. User selects an End Date:

- Opens another date picker

- Selects the end of the range

(e.g., March 31, 2025)

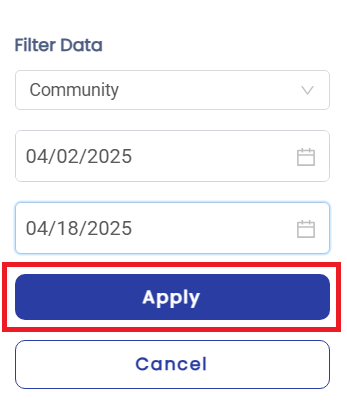

5. User clicks “Apply Filters” button

- Page refreshes or updates instantly to show matching transactions

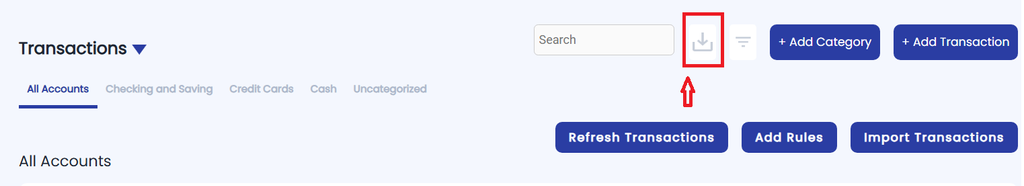

Export All Transactions #

Goal: Allow the user to export their complete transaction as a downloadable file (e.g., CSV, Excel).

Entry Points: #

From Transactions tab → “Export” button

Steps: #

- User clicks “Export Transactions”

- System begins generating file

User Journey: Show All Transactions #

Goal: Provide users with a comprehensive view of all their financial transactions in one place, with options to interact, filter, and manage them.

Entry Points: #

- From Main Navigation Menu → Tap/Click on “Transactions”

Steps: #

- User selects “Transactions”

- Navigates to the Transaction List Screen

- System displays full transaction list

- Optional interactions available per transaction:

- Update Transaction

- Delete Transaction

- History of Transaction

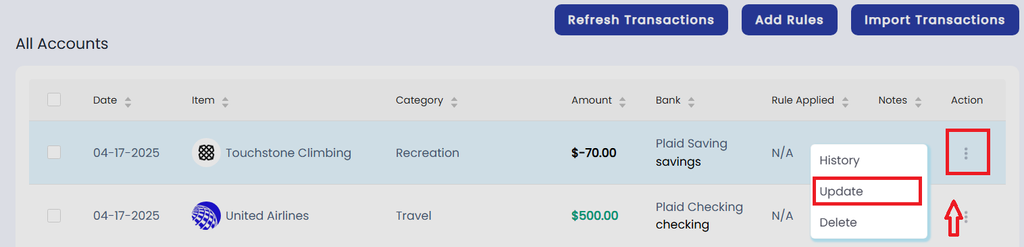

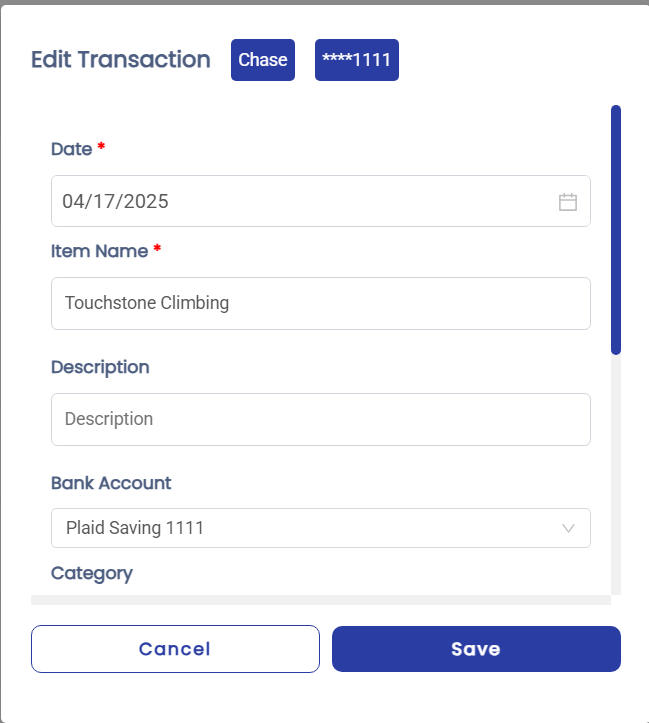

User Journey: Update Transaction #

Goal: Allow the user to edit and update the details of a previously recorded transaction.

Entry Points: #

- From Transactions List View → Click on “Three Dots”

Steps: #

- User clicks on “Edit”

- Opens the Update Transaction Form

- Pre-filled with current transaction data

2. User makes necessary changes to one or more fields:

3. User clicks “Save”

4. User gets the confirmation

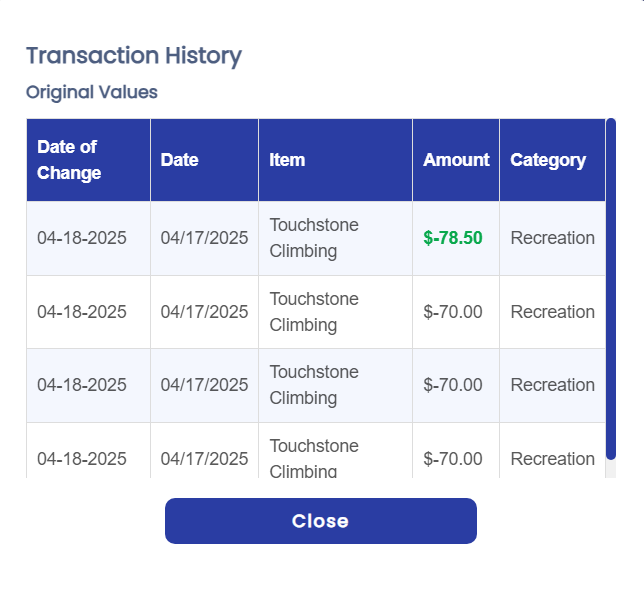

User Journey: View Transaction History #

Goal: Allow users to see a record of all changes made to a specific transaction.

Entry Points: #

- From Transaction List → Click on “Three Dots”

Steps: #

- User clicks “Three Dots” and selects the History option

- Opens up the Transaction History

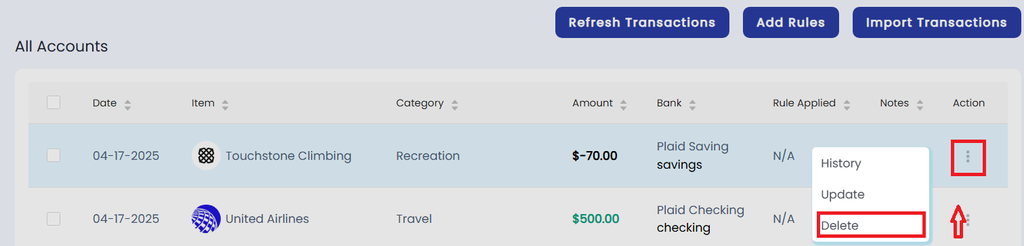

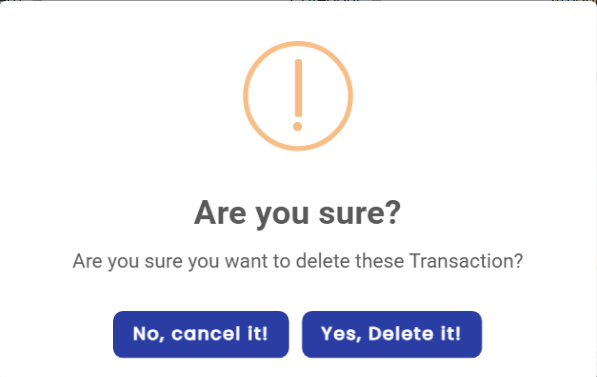

User Journey: Delete a Transaction #

Goal: Allow users to remove a transaction from their account while ensuring clarity, confirmation, and the ability to prevent accidental deletion.

Entry Points: #

- From Transactions List View → Click on “Three Dots”

Steps: #

- User clicks “Delete”

- A confirmation modal appears

- A confirmation modal appears

- User confirms deletion

- Clicks “Yes, Delete it!”

- Alternatively, cancels the action with “No, cancel it!” button